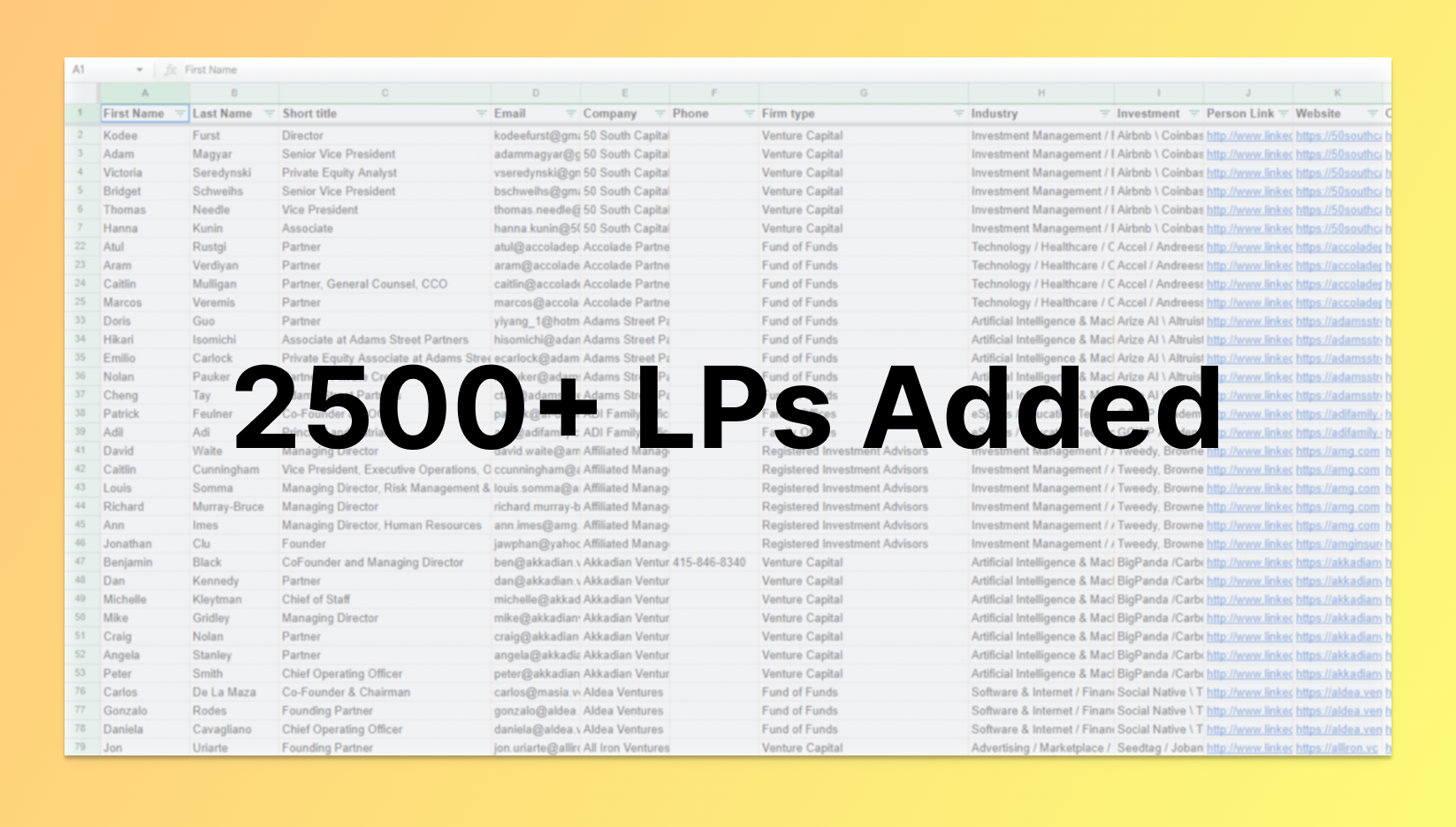

2500 LPs Added to Our Database

TL;DR: We’ve expanded the Fundingstack database with 2,500 Limited Partners (LPs), many of whom actively invest in venture funds and emerging managers.

The Update

Fundraising always starts with the same challenge: building a solid target list of LPs. But finding the right investors can take weeks, sometimes months.

That’s why we’re excited to share this update—we just added 2,500 new LPs, most verified as active investors in venture funds, and many of them open to investing in Emerging Managers. With this addition, VCs will have a larger and more focused pool of potential backers to work with.

Why It Matters

When you’re raising a fund, it’s not about how many names you collect—it’s about whether those investors are the right fit. The expanded dataset helps you:

- Quickly identify LPs who actively invest in VC funds, including Emerging Managers

- Easily filter by geography, firm type, industry, and key decision-makers

- Avoid wasted time by focusing only on relevant conversations

Combined with tools like our CRM, “Get Intro feature,” and Data Room, this update makes the end-to-end fundraising process more efficient and effective.

— Nathan Beckord, CEO, Fundingstack

Who’s Included

These new LPs represent a diverse set of investor types, such as:

- Pension funds & endowments

- Family offices

- Funds of funds

- Insurance companies

- Foundations

- Sovereign wealth funds

- Corporate LPs

- Development finance institutions (DFIs) & government programs

- Wealth managers and registered investment advisors (RIAs)

- High-net-worth individuals (HNWIs)

Each profile gives you the context you need to launch outreach campaigns